Cryptocurrency Crackdown by the ATO before tax time

ATO analysis reveals that amid the pandemic and growing interest in cryptocurrency, more than 600,000 Australian taxpayers have invested in crypto assets. The ATO warned that it would write to about 100,000 taxpayers to alert them to their tax obligations. The growing concerns by the ATO is that taxpayers believe that cryptocurrency gains are tax-free or only taxable when their holdings are cashed into Australian dollars. In a recent article, the ATO are commencing their data matching program now (click here to read more).

ATO assistant commissioner Tim Loh expects the ATO’s proactive engagement to prompt almost 300,000 to lodge their 2021 tax returns.

“This year, we will be writing to around 100,000 taxpayers with cryptocurrency assets explaining their tax obligations and urging them to review their previously lodged returns,” Mr Loh said.

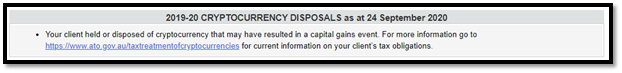

“We also expect to prompt almost 300,000 taxpayers as they lodge their 2021 tax return to report their cryptocurrency capital gains or losses.” MKS Group have already seen prompts by the ATO in this regard, whereby the ATO prefill report for some taxpayers including a statement such as this example below – prompting tax agents to discuss with their clients.

Mr Loh said his office was concerned to learn that the anonymous nature of trading crypto assets led taxpayers to believe their investments were untraceable. He said this year the ATO will head into tax time with access to more data and the ability to track those investing in crypto assets more closely.

“We are alarmed that some taxpayers think that the anonymity of cryptocurrencies provides a licence to ignore their tax obligations,” Mr Loh said.

“While it appears that cryptocurrency operates in an anonymous digital world, we closely track where it interacts with the real world through data from banks, financial institutions and cryptocurrency online exchanges to follow the money back to the taxpayer.”

The ATO will employ data-matching methods to link transactions from cryptocurrency-designated service providers to individuals’ tax returns, to ensure investors are paying the right amount of tax.

The messaging was echoed by Mr Loh, who recently went on record to ensure taxpayers were aware that all transactions — including buying, selling, swapping or exchanging one currency for another — are subject to capital gains tax and must be reported. Irrespective if the taxpayer did not physically receive proceeds such as in Australian dollars.

“The best tip to nail your cryptocurrency gains and losses is to keep accurate records including dates of transactions, the value in Australian dollars at the time of the transactions, what the transactions were for, and who the other party was, even if it’s just their wallet address,” Mr Loh said.

For those who accept cryptocurrencies as a form of payment for goods and services in business activities, Mr Loh said, payments will be taxed as business income, based on whatever the value of the cryptocurrency is in Australian dollars.

Mr Loh concluded by bringing to light the potential penalties for those who fail to report on crypto-assets – failing to report on crypto-assets and not taking action when reminded will prompt penalties and potentially an audit.

The ATO have detailed information available on their website which you can read more about here

If you need assistance with reporting transactions with crypto-assets in your tax return this year please call the team at MKS Group who will be happy to assist: 9374 8400