WHAT IS SINGLE TOUCH PAYROLL?

Single Touch Payroll is a Government initiative that will change the way you report on your payroll to the ATO from 1 July 2018.

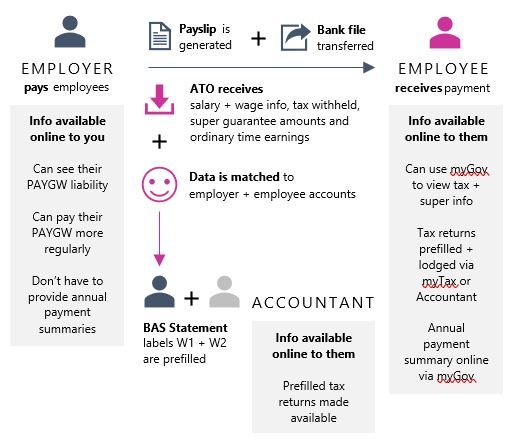

Under Single Touch Payroll (STP) businesses will report on salary or wages, pay as you go (PAYG) withholding and superannuation directly to the Australian Taxation Office (ATO), electronically, and at the same time as you pay your employees.

This new streamlined reporting to the ATO will make it easier for you to meet your payroll processing obligations.

3 KEY STEPS TO BE STP READY

- Does your payroll software support STP reporting? If you are unsure, contact us immediately and we can help you review your business accounting and payroll systems.

- When do you need to start reporting using STP? If on 1 April 2018 you had 20 or more employees, STP is mandatory from 1 July 2018. For businesses with 19 or less your deadline for mandatory reporting is 1 July 2019, however you can opt in for it now.

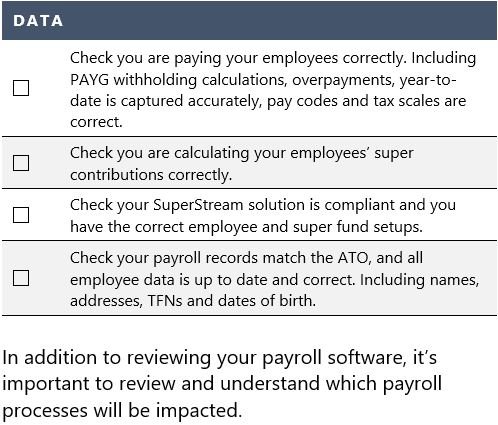

- Is your payroll team aware of these new changes, and your employee data up to date and accurate? You don’t want to start using STP with inaccurate employee information – ask your employees to confirm all the personal details you hold on file for them.

HOW STP WORKS?

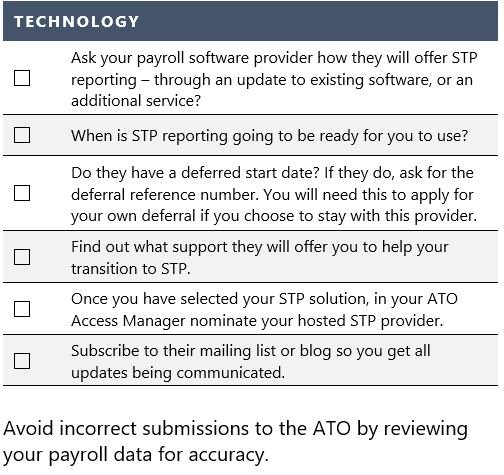

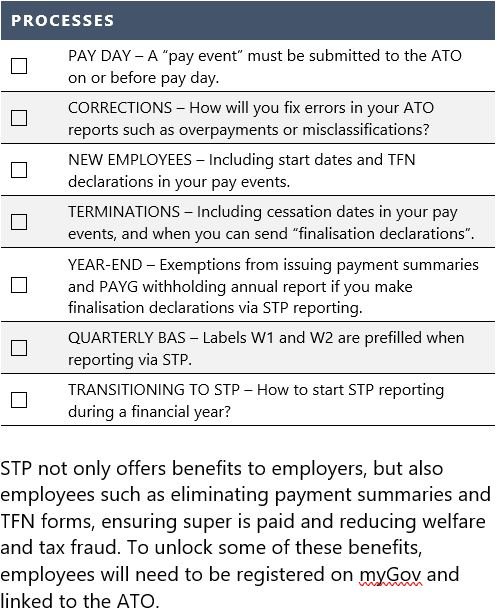

YOUR STP CHECKLIST

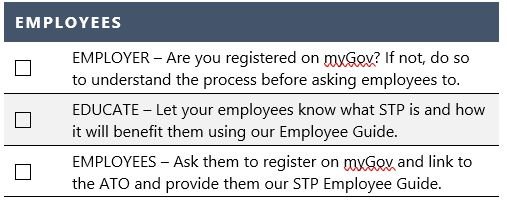

With a tight deadline of 1 July 2018, and STP impacting many parts of your business, not just your payroll software, we have prepared the following checklist to make this transition as easy as possible.

Under STP, your payroll information is being sent electronically to the ATO with every pay run. It is this direct connection to the ATO that is new and requires all payroll systems to be upgraded.

ONCE YOU START USING STP

- You won’t need to provide an end-of-year payment summary to employees.

- STP will allow the ATO to better assist you meet your PAYG withholding and superannuation obligations.

- You may have an option to use a new streamlined, prefilled employee commencement process through myGov.

WANT TO KNOW MORE?

For further information or assistance in reviewing your payroll software solutions and processes to ensure you are ready for the 1 July 2018 deadline, please contact our team of experts today!

MKS Group Pty Ltd

p 03 9374 8400

This article is provided as general information only and does not consider your specific situation, objectives or needs. It does not represent accounting advice upon which any person may act. Implementation and suitability requires a detailed analysis of your specific circumstances.